SUPPLY AND DEMAND

Trustlane ICOs break the mold of financial markets entirely by offering what has come to be known as a “utility token.” This ICO model involves the development of a distributed organization designed to share some resource in a peer-to-peer fashion. The developer designs a miniature economy of sorts, in which the token to be issued is to constitute the only possible medium of exchange, and sells the tokens upfront to fund the venture.

The value of a utility token depends primarily on the demand for goods or services transacted on the platform and the quantity of tokens in circulation. Tokens are divisible and the prices of goods or services in terms of tokens can be adjusted, i.e., the price of a token in fiat currency terms can move

independently of the price of a particular good or service transacted on the platform. The value of tokens is typically enjoyed by the users and not necessarily the operator of the platform.

DBFI Utility tokens’ function as the medium of exchange, or to put it another way, the only “legal tender” within Trutslane respective networks ( ecosystem), creates meaningful parallels with fiat currencies. The miniature economy metaphor is instructive in that it enables one to view the utility token price level through the prism of the QTM ( Quantity Theory of Money). In applying the QTM to utility tokens, we shall define and discuss each of the quantities within the QTM’s “equation of exchange” as it relates to a utility token system.

M × V = P** × Y*

The formula states that the money supply (M) times money velocity (V) equals price level (P) times the volume of goods and services transacted in the economy (Y). *In practice, real gross domestic product (GDP) is substituted into the equation as a measure of volume. **Note: the price level (P) should not be equated with the price of a token, which we subsequently define as (p).

DBFI Fixed Supply Cap.

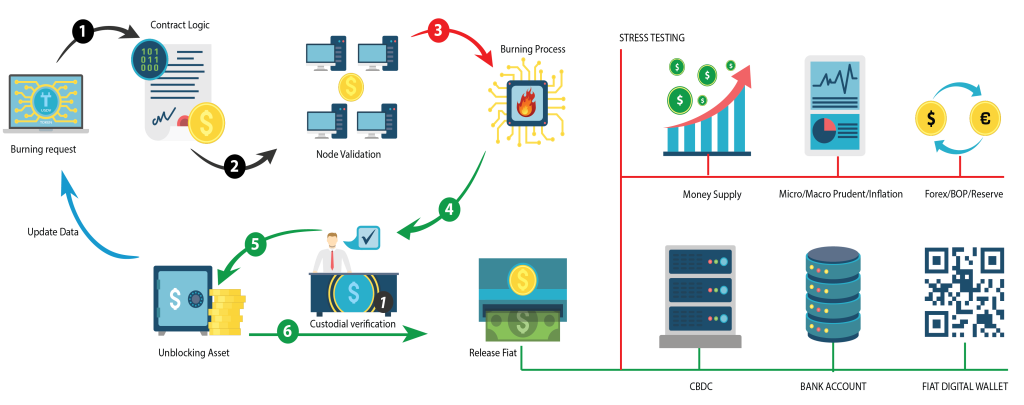

You must have often come across the word supply in the crypto world. Generally, supply stands for the total amount of circulating coins in the market. DBFI token fixed supply 99,999,999 with no feature of minting option. DBFI burning flow has been designed to reduce impact within any economic situation if necessary.

Does Coin Burn affect circulating supply?

Coin burning can increase the price of existing coins because there are fewer coins in circulation. Coins are sent to the burning address if they are to be removed from circulation because neither has the token’s private key, and cannot be retrieved without it. DBFI tokens are programmed systematically each time the tokens are used for platform fees and service fees. DBFI supply is expected to disappear from circulation once it is fully utilized in the ecosystem.

What Is Circulating Supply?

Circulating supply refers to the number of crypto coins being mined and generated at hand in the crypto market. In simple words, it refers to the number of crypto coins in the hands of the people trading and circulating in the crypto market.

Does staking reduce circulating supply?

When a cryptocurrency asset gets staked, it becomes untradeable and locked up. This might lower the number of coins in circulation, raising the currency’s price. Trustlane Staking option available on case to case basis, contact our customer support for more info.

What Is Maximum Supply?

Maximum supply, also known as fixed supply, stands for the maximum number of coins that will ever be available for a specific crypto coin in the digital asset market. The cryptocurrency will never surpass the specific maximum supply. Ultimately, the mining or production of the crypto coin stops after reaching the maximum supply, and there will be no new coins anymore. You can easily calculate the max supply by adding the number of crypto coins still to be produced to those already produced and circulating in the market.

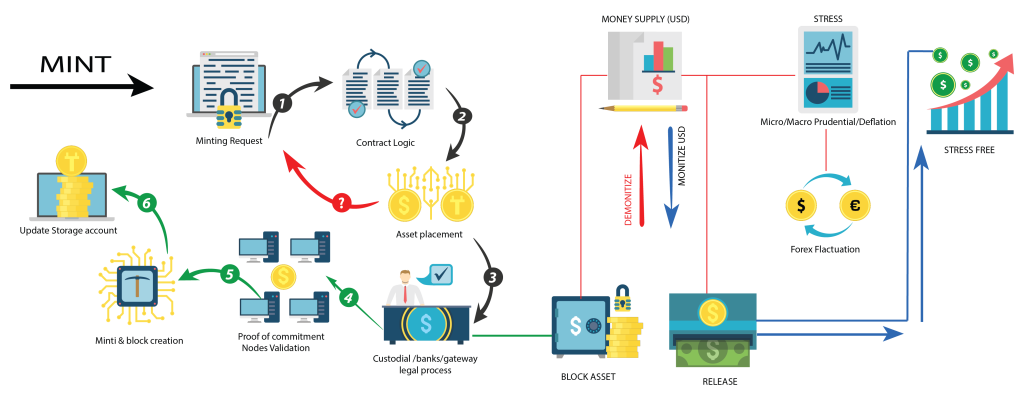

Stable coins.

Trustlane Stable coins are tokens that represent fiat money, playing a critical role in bridging between the traditional fiat world, and the crypto ecosystem. Stablecoins act as a stable, trusted medium of exchange to buy, sell, save, earn, and transfer money around the world. Stablecoins are digital assets with value pegged 1-to-1 to traditional assets like the U.S. dollar, gold, or the Euro. This makes it much easier to transfer money in and out of the crypto ecosystem without having to worry about significant short-term price swings in assets like Bitcoin and Ethereum. One of the most important questions is how a stablecoin achieves price stability – how the stablecoin is collateralized, or how the coin is backed.

Today, there are 3 ways to do so, each following a different approach.

- Fiat-Collateralized Stablecoins

- Crypto-Collateralized Stablecoins

- Algorithmic Stablecoins

Trustlane stable coins is backed by Fiat – collateralized to maintain price stability and votality. users use dollars (or other fiat currency) to buy stablecoins that users can redeem later for original currency. Unlike other cryptos, with value that can fluctuate wildly, fiat-backed stablecoins aim to have very small price fluctuations. Trustlane stablecoins represent USD,EUR,SGD,IDR,RUB backed by cash held by designated custodial banks.

Trustlane minting process and economic stress flow.

The information provided in this communication is of a general nature and should not be considered professional advice. You should not act upon the information provided without obtaining specific professional advice. The information above is subject to change.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Dogecoin

Dogecoin  TRON

TRON  Uniswap

Uniswap  Litecoin

Litecoin  Stellar

Stellar  Monero

Monero  yearn.finance

yearn.finance  Waves

Waves